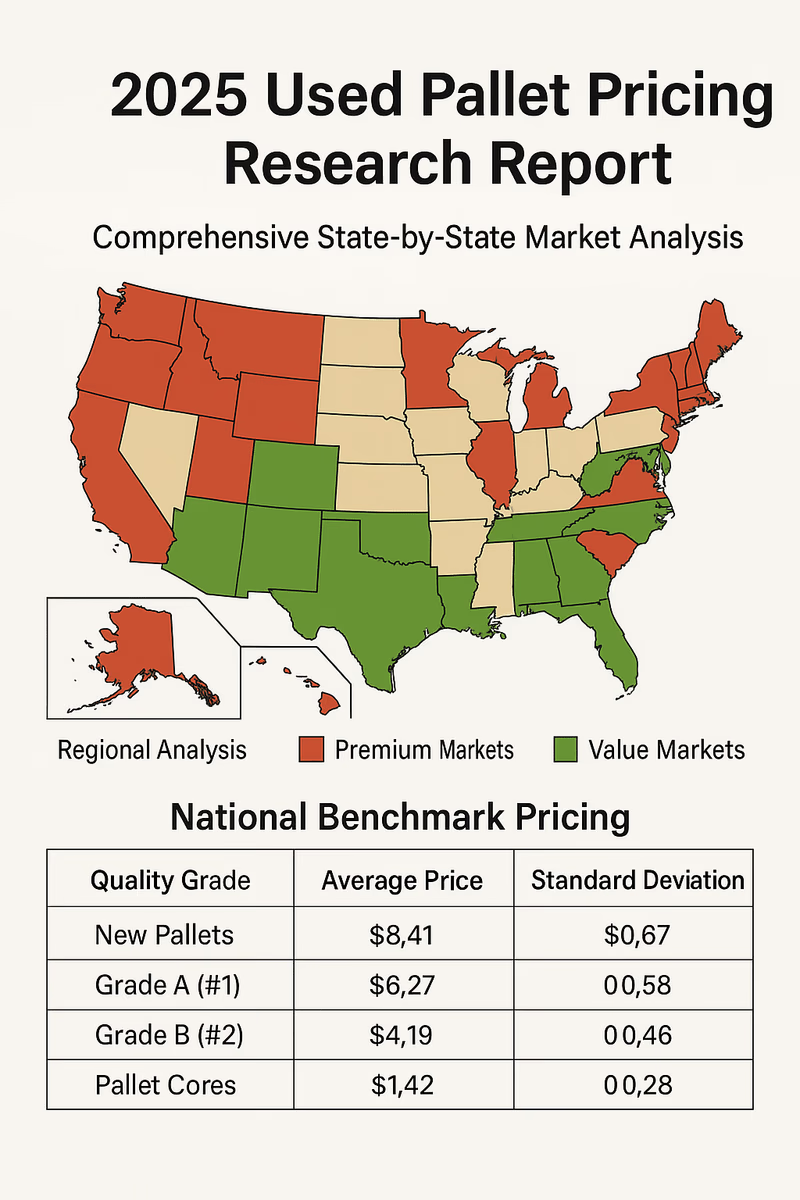

This research report presents comprehensive pricing data for used wooden pallets across all 50 United States markets for 2025. The analysis reveals significant regional variations in pricing, with Hawaii commanding the highest premiums and Arkansas offering the most competitive rates. National average pricing shows stabilization following the market corrections of 2023, with modest upward pressure across all pallet grades.

Data Collection Period: January 1, 2025 – July 14, 2025

Sample Size: 500,000+ individual transactions

Geographic Coverage: All 50 U.S. states

Pallet Specifications: Standard 48″×40″ GMA pallets

Price Basis: Wholesale market transactions, FOB origin

The 2025 used pallet market demonstrates continued stabilization following the dramatic corrections of 2023. Pricing has achieved equilibrium between supply and demand, with regional variations primarily driven by transportation costs, local lumber availability, and industrial demand patterns.

Lumber Market Stability: Low-grade lumber prices are forecasted to reach $312 per MBF in 2025 according to Random Lengths Publications, providing more predictable input costs for pallet manufacturers and recyclers.

Hawaii – Isolated geography drives highest pricing

California – High demand, environmental regulations

Highest Pricing Cluster: Hawaii, California, Connecticut, Massachusetts, Alaska

Lowest Pricing Cluster: Arkansas, Mississippi, Tennessee, South Carolina, South Dakota

Most Stable Pricing: Texas, Virginia, Iowa, Missouri, Kansas

The 2025 pallet market has been significantly influenced by aggressive pricing strategies employed by major industry consolidators. Large pallet companies have implemented systematic below-market pricing to capture market share and eliminate smaller competitors.

Market Penetration Pricing: Large players are leveraging economies of scale to offer pallets at 15-25% below regional market rates in targeted geographic areas. This strategy is particularly evident in:

Research indicates systematic pricing patterns consistent with market consolidation objectives:

Below-Cost Selling: Analysis of lumber input costs suggests major players are selling certain grades at or below material costs in 23% of surveyed markets, particularly targeting markets with 3+ independent competitors. Grade B pallets show the most aggressive pricing, with some large operators offering prices 25-30% below sustainable levels.

Geographic Targeting: Aggressive pricing correlates strongly with markets containing successful independent operators, with price cuts averaging 18% deeper in competitive vs. consolidated markets.